Because preferred stock dividends are also a cash flow available to one of the company’s capital providers, this item is added back to net income available to common shareholders in deriving FCFF.įixed Capital Investment (FCInv): represent the outflows of cash to purchase fixed capital necessary to support the company’s current and future operations. Similar to after-tax interest expense, if a company has preferred stock, dividends on that preferred stock are deducted in arriving at net income available to common shareholders. For consistency, we thus compute FCFF by using the after-tax interest paid. As we explain later, when we discount FCFF, we use an after-tax cost of capital. In the United States and many other countries, interest is tax deductible (reduces taxes) for the company (borrower) and taxable for the recipient (lender). In the case of intangible assets, there is a similar noncash charge, amortization expense, which must be added back.Īfter-tax Interest Expense: This step is required because interest expense net of the related tax savings was deducted in arriving at net income and because interest is a cash flow available to one of the company’s capital providers (i.e., the company’s creditors). Depreciation expense decreases net income but is not a cash outflow. The most common noncash charge is depreciation expense. If noncash increases exceed noncash decreases, the adjustment is negative. If noncash decreases in net income exceed the increases, as is usually the case, the adjustment is positive. This adjustment is the first of several that analysts generally perform on a net basis.

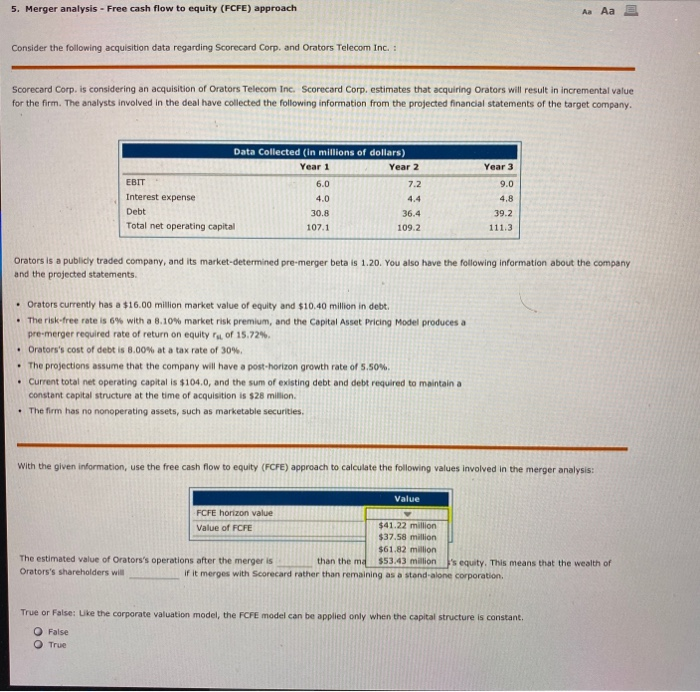

Non-Cash Charges (NCC): Net noncash charges represent an adjustment for noncash decreases and increases in net income. It represents income after depreciation, amortization, interest expense, income taxes, and the payment of dividends to preferred shareholders (but not payment of dividends to common shareholders). Net Income (NI): the bottom line in an income statement. The value of equity can also be estimated directly by discounting FCFE at the required rate of return for equity (because FCFE is the cash flow going to common stockholders, the required rate of return on equity is the appropriate risk-adjusted rate for discounting FCFE).įCFE is usually used if the company’s capital structure is relatively stableįCFF is often used for a levered company with a negative FCFE and a levered company with a change capital structure An estimate of the value of equity is then found by subtracting the value of debt from the estimated value of the firm.

FREE CASH FLOW TO EQUITY FREE

Net income and CFO data can be used, however, in determining a company’s free cash flow.īecause FCFF is the after-tax cash flow going to all suppliers of capital to the firm, the value of the firm is estimated by discounting FCFF at the weighted average cost of capital (WACC). Although a company reports cash flow from operations (CFO) on the statement of cash flows, CFO is not free cash flow. The way in which free cash flow is related to a company’s net income, cash flow from operations, and measures such as EBITDA (earnings before interest, taxes, depreciation, and amortization) is important: The analyst must understand the relationship between a company’s reported accounting data and free cash flow in order to forecast free cash flow and its expected growth.

FREE CASH FLOW TO EQUITY PLUS

FCFE is the cash flow from operations minus capital expenditures minus payments to (and plus receipts from) debtholders.

A company’s suppliers of capital include common stockholders, bondholders, and sometimes, preferred stockholders.įree Cash Flow to Equity: the cash flow available to the company’s holders of common equity after all operating expenses, interest, and principal payments have been paid and necessary investments in working and fixed capital have been made. FCFF is the cash flow from operations minus capital expenditures. Free Cash Flow to the Firm: the cash flow available to the company’s suppliers of capital after all operating expenses (including taxes) have been paid and necessary investments in working capital (e.g., inventory) and fixed capital (e.g., equipment) have been made.

0 kommentar(er)

0 kommentar(er)